A binary indicator operates on easy logic: it generates one among two states per candle. Consider it like a lightweight change—both on or off, purchase or promote, bullish or bearish. In contrast to oscillators that transfer via a variety of values, binary indicators make clear-cut selections.

The “no repaint” side is the place issues get vital. When an indicator doesn’t repaint, its sign for a closed candle stays mounted. If it confirmed a purchase arrow on the shut of the ten:00 AM candle, that arrow stays there whether or not the market strikes up or down afterward. This consistency permits you to backtest precisely and commerce with confidence.

Most binary indicators base their calculations on worth motion, transferring averages, or momentum shifts. They course of this knowledge and output a definitive sign. The MT4 platform shows these as arrows, dots, or coloured bars in your chart. What separates the nice from the mediocre is the underlying algorithm and whether or not it respects the closed-candle rule.

How the Binary Logic Works

Right here’s what occurs below the hood. The indicator runs its calculation on the shut of every candle—let’s say you’re buying and selling GBP/USD on the 15-minute timeframe. At 2:15 PM, the two:00-2:15 candle closes. The indicator checks its circumstances: Possibly it’s evaluating the 50-period EMA to the 200-period EMA, or evaluating whether or not the candle closed above a pivot level.

If circumstances are met, the indicator plots its sign. That sign is tied to that particular candle’s shut. The following candle opens, worth does no matter it desires, however the sign on the two:15 bar doesn’t change. That is the non-repainting habits merchants want.

Evaluate this to repainting indicators that recalculate based mostly on present worth. A repainting instrument would possibly present a purchase sign whereas the present candle is forming, then delete it if worth reverses earlier than the shut. Backtests look unimaginable as a result of the indicator “knew” each flip. However in reside buying and selling? You’re chasing alerts that disappear.

The calculation frequency issues too. Some binary indicators replace each tick throughout candle formation however solely commit the sign at shut. Others wait till the near even run. Each approaches can work, however you should know which one you’re utilizing.

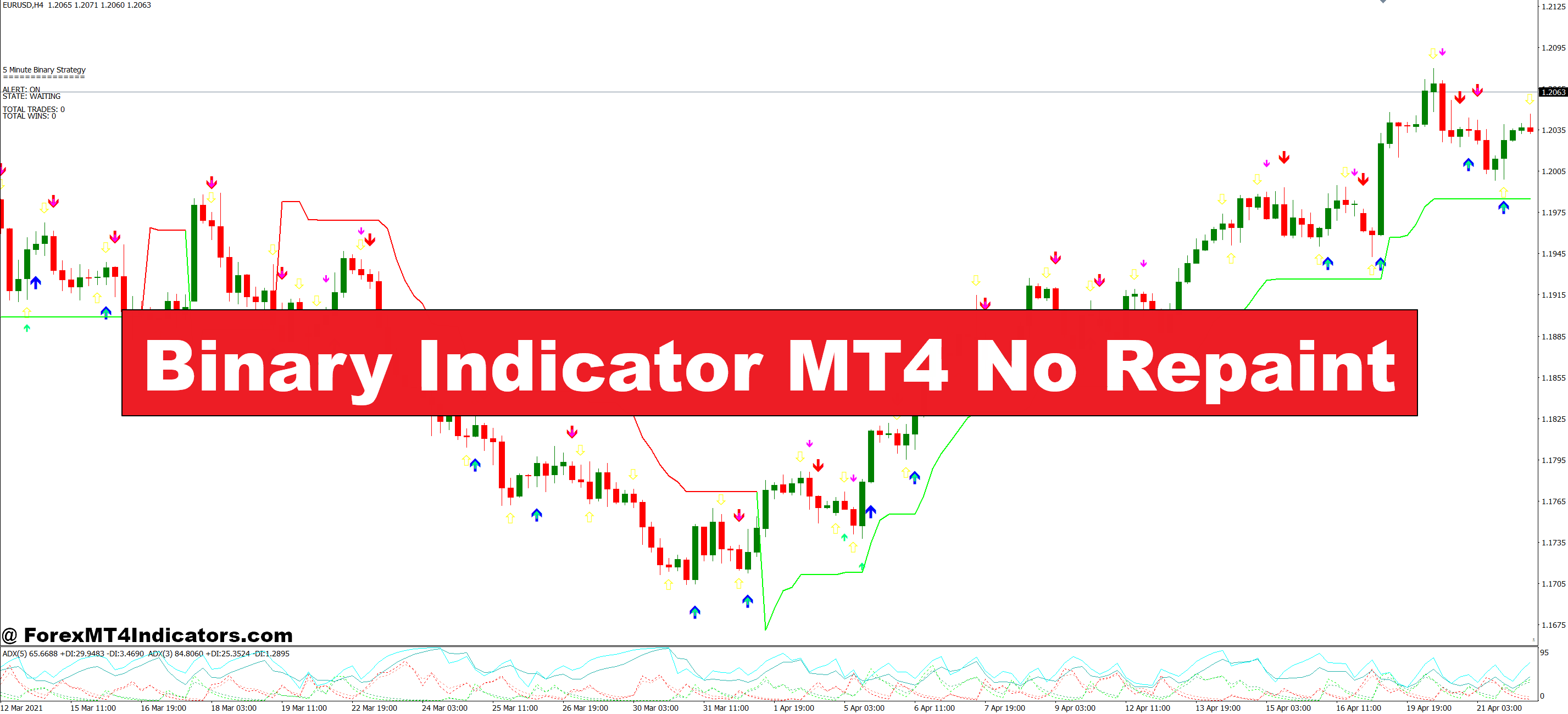

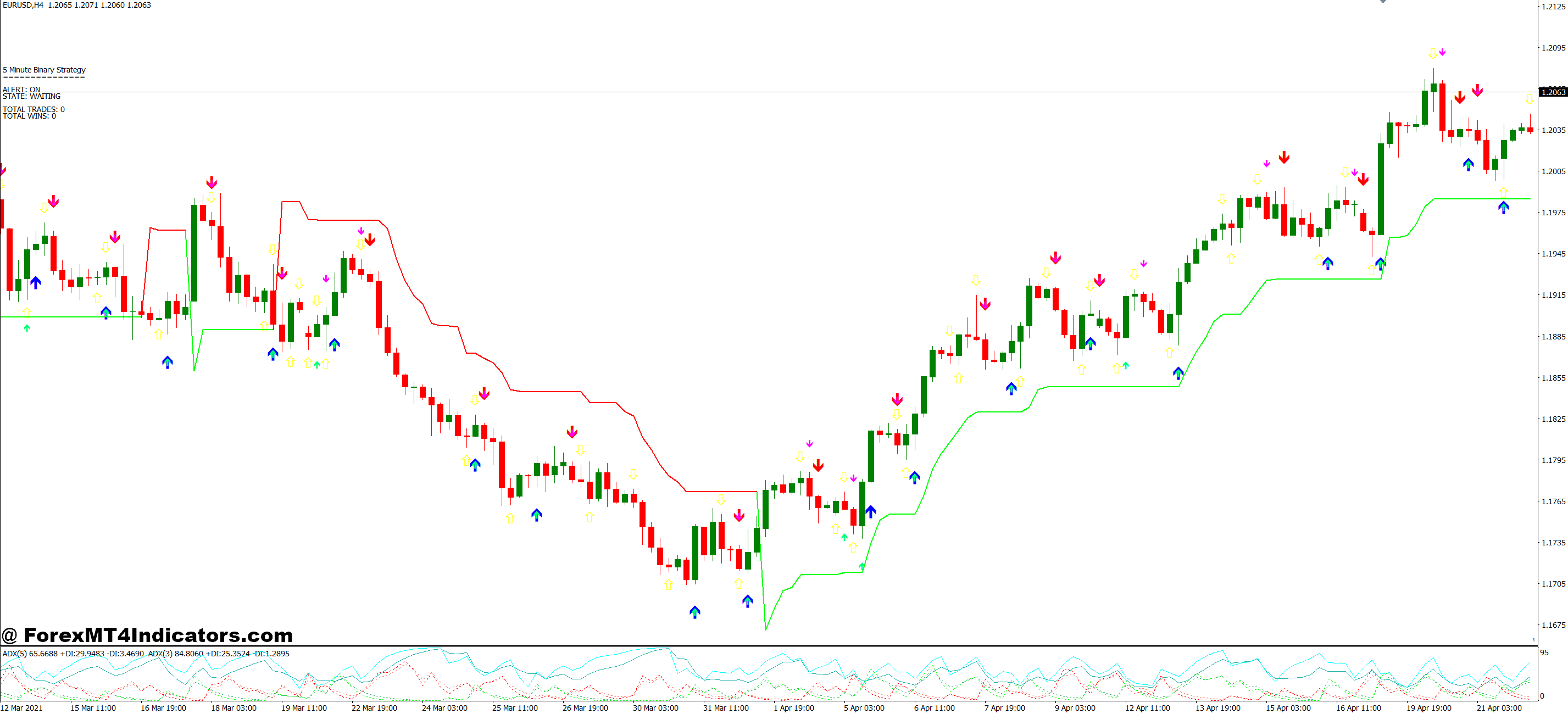

Sensible Software on Stay Charts

Testing this on USD/JPY through the Tokyo session revealed some attention-grabbing patterns. The 1-hour chart confirmed cleaner alerts than the 5-minute. Is sensible—greater timeframes filter out market noise. When the indicator flashed a promote sign on the shut of the three:00 AM bar (EST), worth was sitting at 149.80. The following three hours noticed a 70-pip drop.

However right here’s the factor: not each sign performs like that. The identical setup on uneven Friday afternoons produced whipsaws. The indicator did its job—it generated alerts based mostly on its logic—however the market circumstances didn’t cooperate. That’s buying and selling.

For forex pairs, volatility impacts sign high quality. EUR/USD through the London-New York overlap offers you quantity and motion. Alerts are likely to comply with via higher than through the Asian session when EUR pairs barely transfer. I’ve observed GBP pairs give sharper strikes but in addition extra false alerts. You’re buying and selling likelihood, not certainty.

Place sizing round these alerts makes a distinction. As an alternative of going all-in on each arrow, think about the broader context. Is the sign aligned with the each day pattern? Are you close to main help or resistance? The binary indicator supplies the set off, however you continue to want market construction affirmation.

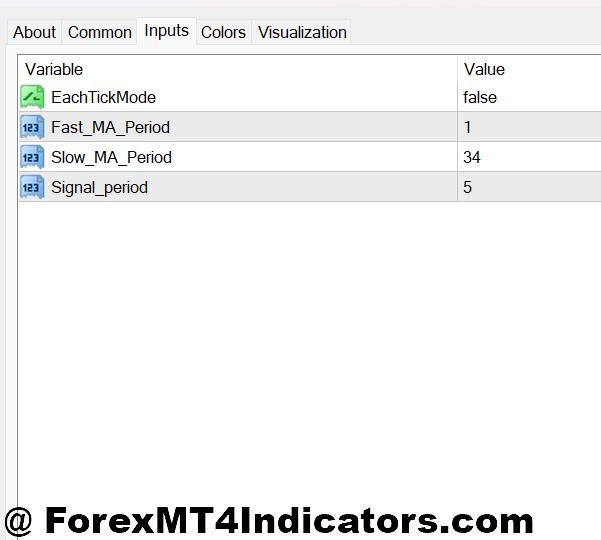

Settings and Customization Choices

The usual setup works for a lot of merchants, however tweaking parameters can match your model. Most binary indicators allow you to alter the lookback interval—the variety of candles the algorithm analyzes. A shorter interval (like 10 bars) reacts sooner however generates extra alerts, together with false ones. An extended interval (50+ bars) is slower however extra selective.

Some indicators embody filters. You would possibly discover an ADX filter that solely permits alerts when the Common Directional Index exceeds 25, confirming a trending market. Or a time filter that blocks trades throughout low-volume hours. These add-ons assist, however additionally they cut back sign frequency.

Shade and visible settings appear minor till you’re scanning eight charts concurrently. Clear, contrasting colours forestall missed alerts. I want brilliant inexperienced for buys and pink for sells—primary, however it works once you’re making fast selections.

Alert settings deserve consideration. Desktop alerts are effective if you happen to’re glued to your screens. Cell push notifications work higher for merchants who step away. E-mail alerts? Too gradual for shorter timeframes, however serviceable for each day charts.

Benefits Price Contemplating

The backtesting accuracy alone justifies utilizing non-repainting indicators. You possibly can run historic assessments and belief the outcomes replicate what truly occurred. Repainting instruments present 90% win charges in testing, then ship 50% reside. Non-repainting indicators would possibly backtest at 55%, however that 55% is actual.

Psychological advantages matter greater than merchants admit. When you realize your alerts received’t disappear, you commerce them with conviction. No second-guessing, no refreshing charts hoping the arrow comes again. This consistency builds belief in your system, which ends up in higher commerce execution.

The binary format simplifies decision-making. You don’t must interpret whether or not RSI at 68 is “overbought sufficient” to promote. The indicator handles the evaluation and provides you a transparent directive. For systematic merchants who need to take away emotion, this readability is effective.

Integration with Professional Advisors (EAs) runs smoother with non-repainting indicators. Your EA can reliably execute trades based mostly on alerts that received’t vanish, making automated methods extra strong.

Limitations You Ought to Know

No indicator predicts the longer term. This instrument identifies circumstances based mostly on historic patterns, however markets change. What labored throughout trending 2023 would possibly fail in rangy 2024. The binary indicator MT4 no repaint exhibits you alternatives; it doesn’t assure income.

False alerts are inevitable. Even one of the best configurations produce dropping trades. The market doesn’t care about your indicator’s logic. Value can set off a purchase sign, then instantly reverse right into a cease loss. Danger administration—correct place sizing and cease placement—stays your duty.

Lagging is inherent in most binary indicators since they look forward to candle closes. On sooner timeframes, this delay prices pips. By the point you get the sign and execute, worth may need already moved 10-15 pips. Slippage and unfold add to this value.

Over-optimization is tempting. Merchants backtest, discover the “excellent” settings that produced 80% winners final 12 months, then these settings fail going ahead. Markets evolve, and curve-fitted parameters usually don’t adapt. Easy, strong settings usually outperform overly advanced ones.

How It Compares to Alternate options

Customary transferring common crossovers give comparable binary alerts (both in a bullish or bearish cross), however they lag considerably. The benefit there may be simplicity and common recognition—each dealer understands a 50/200 EMA cross. Binary indicators usually reply sooner by incorporating extra components.

Oscillator-based methods like RSI or Stochastic provide nuance. You possibly can see overbought/oversold ranges growing, supplying you with warning earlier than alerts hearth. However that nuance requires interpretation. Binary indicators make the choice for you, which some merchants want and others discover limiting.

Proprietary indicators that repaint would possibly look wonderful in backtests, however they’re buying and selling fiction. You’re evaluating fantasy outcomes to actual efficiency. The non-repainting binary indicator offers you sincere knowledge, even when it’s much less spectacular statistically.

Sample recognition instruments establish formations like head and shoulders or flags. These present context binary indicators typically miss. Combining each—utilizing the binary indicator for timing inside patterns—can work properly.

Methods to Commerce with Binary Indicator MT4 No Repaint

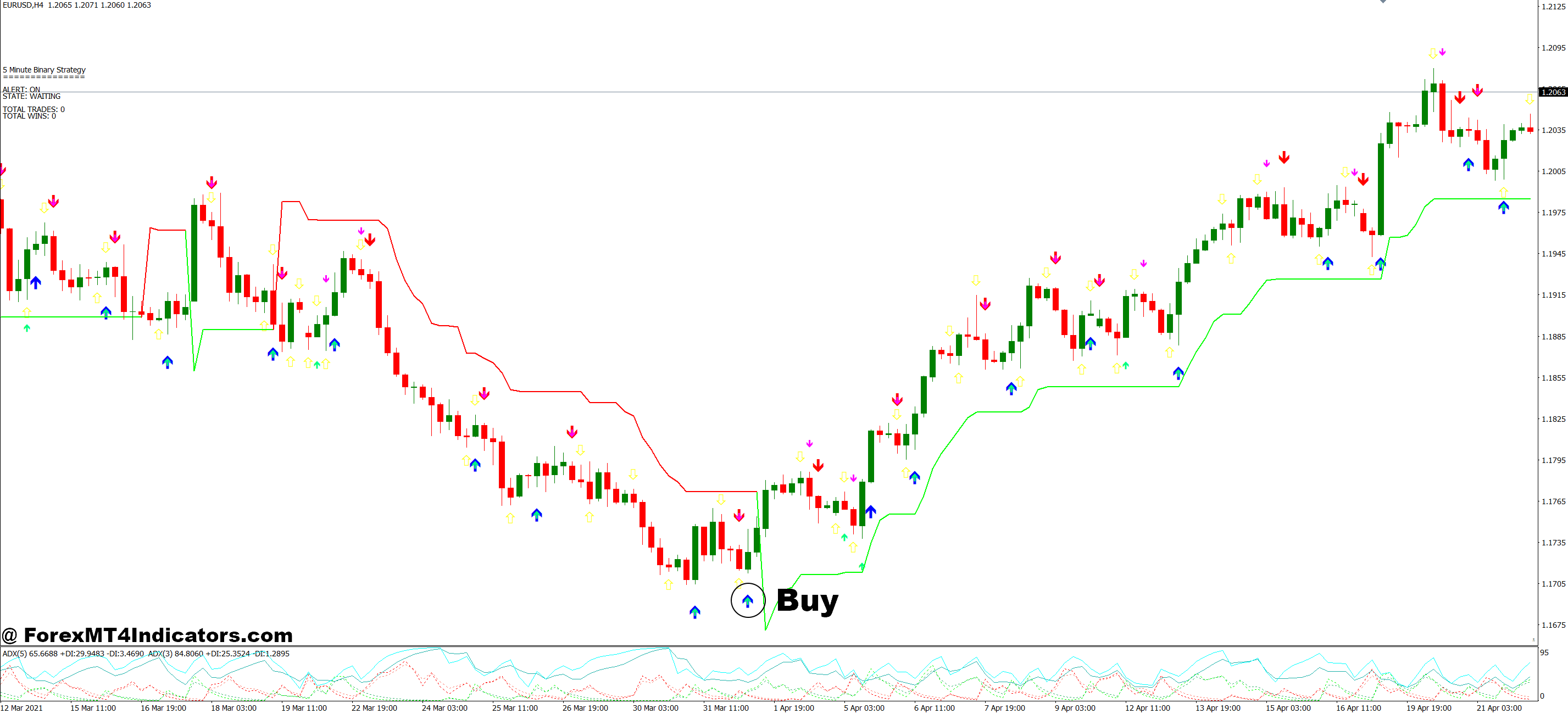

Purchase Entry

- Watch for candle shut affirmation – By no means enter on a forming candle; wait till the bar absolutely closes with the purchase arrow exhibited to keep away from false alerts on EUR/USD 15-minute charts.

- Verify the upper timeframe pattern – Verify the 4-hour or each day chart exhibits bullish construction earlier than taking 1-hour purchase alerts; this filters out 60-70% of counter-trend losers.

- Place cease loss 5-10 pips beneath sign candle low – On GBP/USD, account for volatility through the use of 10-pip stops; on EUR/USD, 5-7 pips normally suffices throughout London session.

- Keep away from purchase alerts through the Asian session – EUR and GBP pairs lack quantity from 8 PM-2 AM EST, producing whipsaws that hit stops earlier than any actual transfer develops.

- Goal 1.5-2x your danger minimal – For those who’re risking 10 pips, goal for a minimum of 15-20 pips revenue; this maintains constructive expectancy even with 50% win charge.

- Skip alerts inside 10 pips of main resistance – If EUR/USD flashes a purchase at 1.0995 however resistance sits at 1.1000, look forward to a breakout or move totally.

- Cut back place dimension after 2 consecutive losses – Minimize your lot dimension by 50% after back-to-back dropping purchase alerts till you catch a winner; protects capital throughout uneven circumstances.

- Don’t chase alerts greater than 3 candles previous – For those who missed the entry when the arrow appeared, let it go; coming into late on the 1-hour chart usually means giving up 15-30 pips of potential revenue.

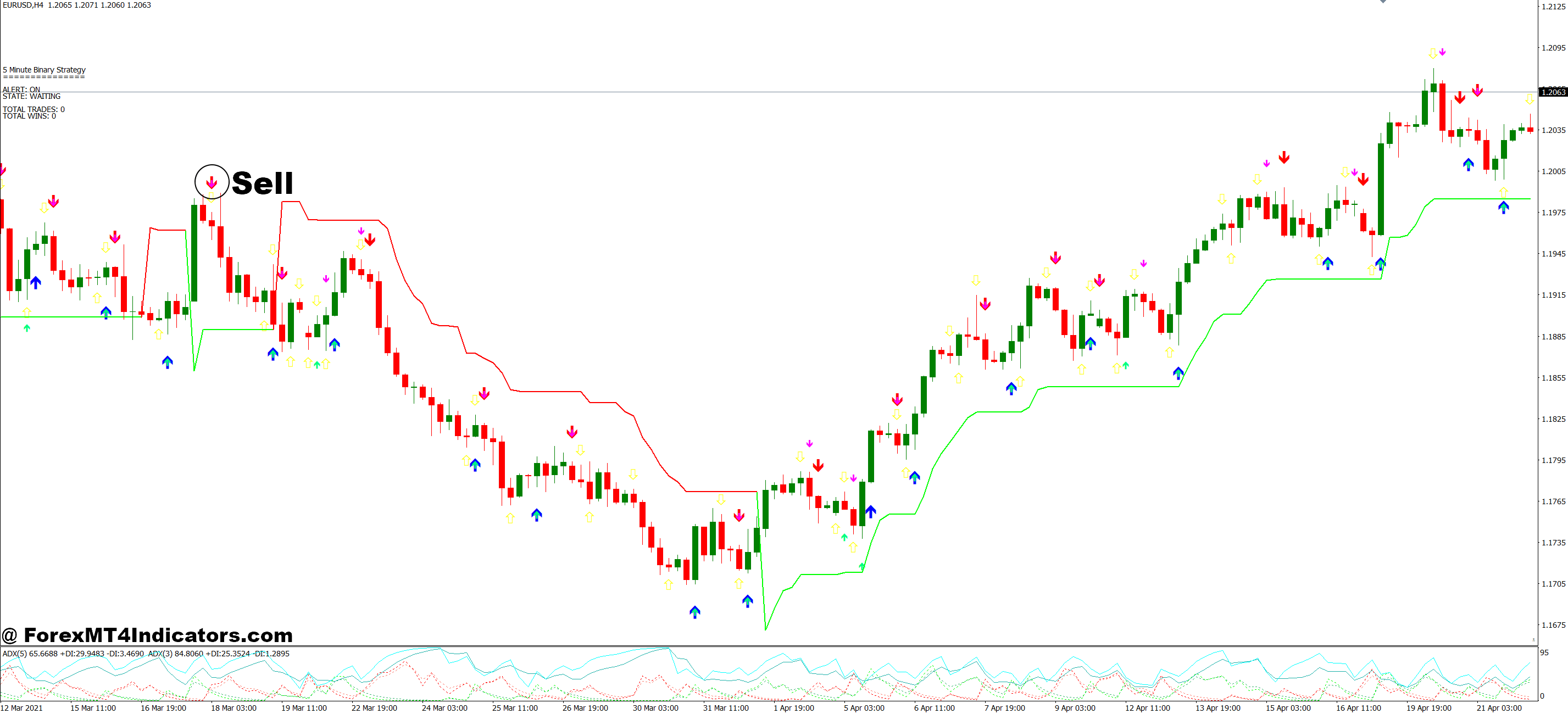

Promote Entry

- Confirm the promote arrow seems after candle shut – The indicator ought to plot the sign solely when the bar completes; if it exhibits mid-candle, your settings could enable repainting.

- Align with downtrending greater timeframes – Take 1-hour promote alerts solely when the 4-hour chart exhibits decrease highs and decrease lows; alignment will increase win charge by roughly 30-40%.

- Set cease loss 5-10 pips above sign candle excessive – GBP/USD wants wider stops (8-10 pips) attributable to sharper spikes; EUR/USD performs higher with tighter 5-7 pip stops.

- Ignore promote alerts throughout main information releases – NFP, FOMC, and central financial institution selections create erratic worth motion that invalidates technical alerts inside seconds.

- Take partial income at 1x danger – Lock in half your place once you’ve gained the identical pips you’re risking, then let the rest run to 2-3x danger.

- Skip alerts inside 10 pips of sturdy help – A promote arrow at 1.0505 when help holds at 1.0500 on EUR/USD is asking for a bounce that’ll cease you out.

- Keep away from Friday afternoon alerts after 12 PM EST – Weekend danger and skinny liquidity make late-week alerts unreliable; 65% of Friday PM alerts fail to succeed in goal earlier than the shut.

- By no means commerce each instructions concurrently – For those who’re holding a purchase commerce on EUR/USD, don’t take a promote sign on the identical pair even on completely different timeframes; decide one directional bias per session.

Closing Ideas

Binary indicators that don’t repaint convey reliability to an business stuffed with smoke and mirrors. They received’t make you wealthy in a single day, they usually’ll generate dropping trades alongside winners. However they offer you constant alerts you possibly can truly backtest, systematize, and belief.

The actual worth comes from integration into a whole technique. Use the indicator as your set off mechanism, however construct round it with correct danger administration, market construction evaluation, and practical expectations. Check it totally on demo accounts throughout completely different pairs and timeframes earlier than risking actual capital.

Buying and selling foreign exchange carries substantial danger. No indicator ensures income, and previous efficiency doesn’t guarantee future outcomes. This instrument is a part of a toolkit, not a magic resolution. Method it with the skepticism it deserves, take a look at it rigorously, and use it as one part in a disciplined buying and selling plan.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90